A company in Hong Kong can legally carry out many activities. Here are the three most common activities in Hong Kong and an explanation of the solutions usually implemented:

Import-Export or “Trading” Companies

This is the most common use of companies registered in Hong Kong.

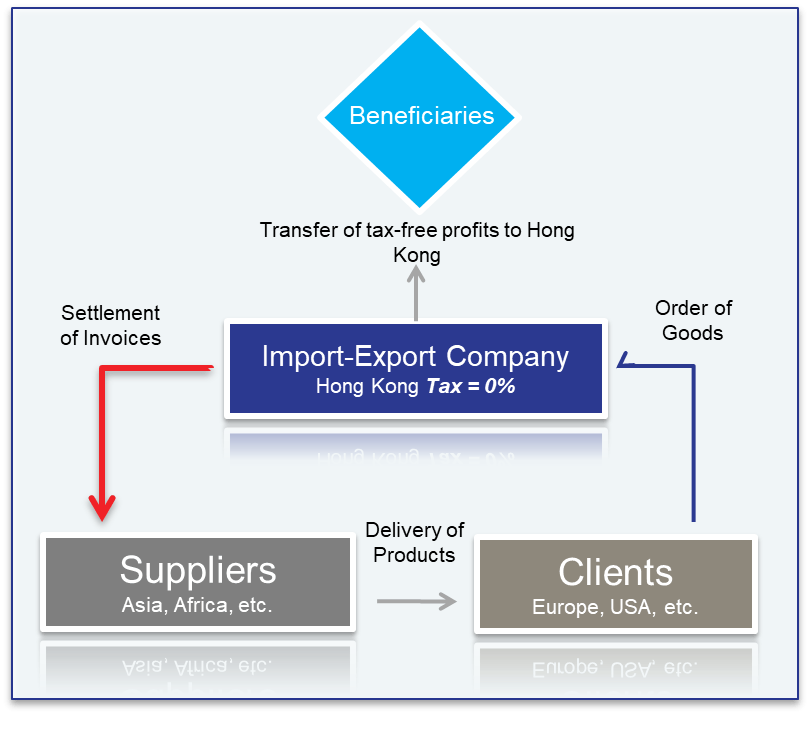

Your company can bill any customer (individuals or companies) regardless of location and receive products and services from suppliers around the world (not just Asia). As Hong Kong is at the center of one of the most dynamic economic zones in the world, your company will be at the heart of international trade. If the goods you are trading are only passing through Hong Kong (because they come from China or any other country), or if they do not pass through Hong Kong at all, you will have no taxes payable in Hong Kong.

Import-export Operational Structure:

Contact us if this business structure is suitable for your activity and your expectations.

Consulting or Services Companies

Hong Kong is a suitable jurisdiction for consultant, service companies, or e-commerce.

“…in Hong Kong, e-commerce activities are expected to be worth US $ 70 billion, ranking it in the top ten on the charts of the most e-commerce-friendly countries set by the Economic Intelligence Unit. from London”. Source: OECD

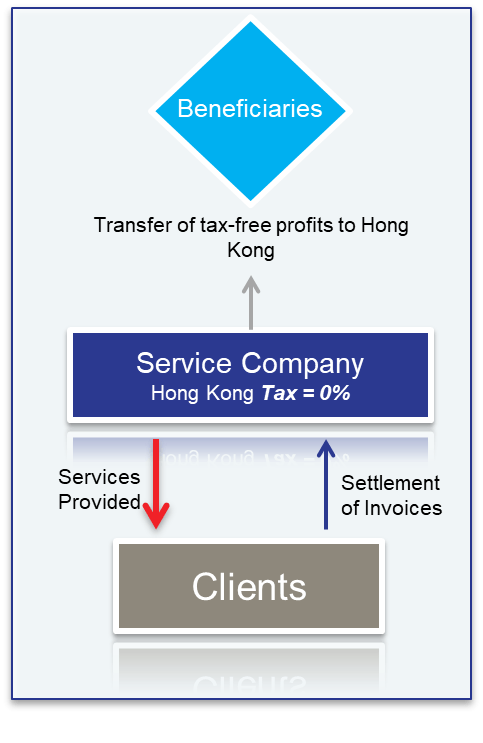

If your company’s turn over is earned outside of Hong Kong, it will have no tax to pay.

Consulting & Services Operational Structure:

Contact us if this business structure is suitable for your activity and your expectations.

Holding or Equity Holding Companies

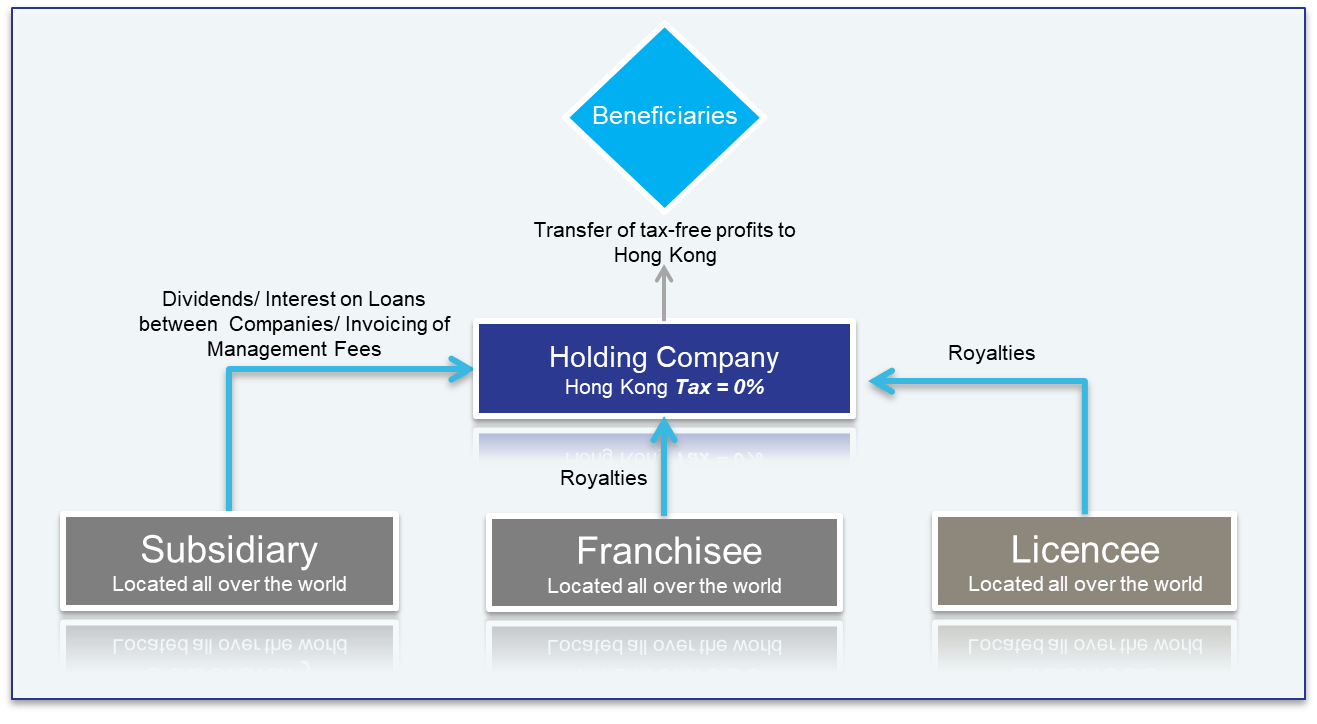

The holding company business structure consists of a parent company and a subsidiary. Hong Kong is an international center that allows:

- a parent company that will take stakes in subsidiaries around the world;

- a subsidiary to re-group the foreign activities of a group.

Hong Kong does not tax dividends or capital gains. In addition, Hong Kong benefits from an increasingly dense tax treaty network, which limits double taxation for dividends, royalties, and interest.

- CAUTION: Many tax administrations across the world now apply anti-abuse rules more vigorously and are more vigilant against any lack of “economic substance”. In most cases, “mail box companies” can no longer claim a tax exempt status.

Therefore, a holding company in Hong Kong is not adequate for claiming tax exempt status if the company does not have staff or offices (owned or leased) physically in Hong Kong. Please contact us in this case so we can advise you about another jurisdiction.

Holding company Operational Structure:

Contact us if this business structure is suitable for your activity and your expectations.